~ By Charmaine Mirza

Did you… just buy your airline tickets online instead of the family travel agent? Shop for your groceries on a website vs. a “kiraana dukaan”? If so, you’re already part of a fintech revolution that is sweeping Asia off it’s feet.

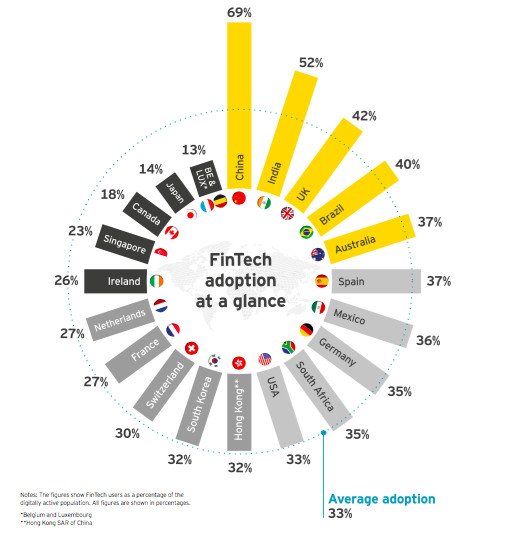

In the race for adoption, China leads the pack. But India is fast catching up. Is this something that China needs to be concerned about? Not really – because when you just paid your highway toll in India using PayTM, did you realize that it’s powered by the Chinese tech powerhouse – Alibaba? Or that your last Zomato order could take place thanks to Ant Financial’s investment in them?

China is a global fintech leader, but as the government started to cash in on the FinTech boom and spike the interest rates for home-grown companies in China, several of them have opted to look beyond the Middle Kingdom to grow their business and achieve global leadership in the FinTech space.

BORDER CROSSING:

The Chinese administration has clamped down recently and imposed several regulations and restrictions on financial service companies and their customers. While some people believe that this is not necessarily a bad thing, it could be the harbinger of a slow down in growth within China itself. Therefore, Ant, Tencent and others are looking at other parts of Asia to grow their business. This is precisely where India zooms into focus.

“Alipay Singapore – the Singapore branch of Ant Financial, and Zomato have sealed a US$210 investment deal, just six months after the world’s largest fintech company made a US$150 million investment in the South Asian food delivery firm. The latest investment will be for a 10% stake in Zomato, bringing the Indian company’s valuation to around US$2 billion.

The deal comes just as reports that Chinese internet giant Tencent plans to invest as much as US$700 million in Swiggy, Zomato’s main competitor in the Indian market, after previously accepting investments from Tencent-backed Meituan-Dianping.”

NUMBER CRUNCH:

According to a recent report by JP Morgan, fintech firms in India have only succeeded in catering to 23 percent of the affluent section of the Indian economy while a huge portion – roughly a 600-million-strong population mostly of lower- and middle-income groups still remains untapped. Furthermore, the fintech landscape is lead by market place lending at around 29-30%. Payments and remittances come next at around 25-27%. A plethora of categories including savings and investments, borrowings and financial planning services yet need to break into the Indian market, leaving the potential for growth not only in volume but also categories.

The potential for growth in India, especially Bharat (rural India) is huge – and Chinese fintech companies are ready to cash in, literally. Isn’t it ironic? CEO Eric Jing says that Ant Financial got its name because ‘ants are small and its service was for the “little guys.”’ What these companies are counting on is volume led growth.

WeCash, one of the largest players in the lending space in China has already set up shop in India, and entered with a consumer-lending product in partnership with banks. They aim to source borrowers for banks. Their goal: to target the masses – the vast number of people across various regions of the country who have remained financially underserved by traditional brick and mortar institutions.

Is there a future? Inchin Closer certainly thinks so. In a world where currency is moving towards a paperless model, FinTech has a far more significant role to play and the Chinese have the advantage. Follow us as we bring you further insights into the future of Chinese fintech investments in India and the reasons why.