The often floundering, fragile Indian economy is relatively looking positive in light of recent changes within her BRICS peers. The rupee is trading at an eight month high of Rs. 60.17 to the dollar and the benchmark Sensex stock index, closed above 22,000 for the first time on Monday, reaching a record 22,055. India’s equity market is up 6 percent this year, while the emerging market index is down about a percent in the same period.

The often floundering, fragile Indian economy is relatively looking positive in light of recent changes within her BRICS peers. The rupee is trading at an eight month high of Rs. 60.17 to the dollar and the benchmark Sensex stock index, closed above 22,000 for the first time on Monday, reaching a record 22,055. India’s equity market is up 6 percent this year, while the emerging market index is down about a percent in the same period.

Foreign investors, including the Chinese government and companies are looking at investing in their largest southern neighbour as the Chinese market saturates. So far this year foreign investors have poured US$2 billion into Indian equities, reversing the recent outflow trend. While Beijing is keen to invest in India’s high speed railways sector altering a mode of transport for millions and entering a sensitive Indian industry and the largest employer in the world, Chinese companies are also keen to tap into India. Of late mobile phone manufacturers Xiaomi and Gionee the 10th largest mobile handset maker in the world, both have ambitious plans of expansion and growth within India, the second largest mobile consumer market after China.

The slew of Chinese investments come after larger Chinese mobile manufacturers Huawei and ZTE laid the groundwork and established a firm market for Chinese companies in India. Considering that the Indian population is expected to exceed the Chinese population this year, and the potential for earnings growth in India remains very appealing at 12 to 16 percent growth for the next year or two, the market is rife for investment by Chinese companies.

“India has a very good future. Demographics are better than in most countries. Workforce age is increasing. It has a middle class that over the next five years will probably double in size,” Bill Witherell, Cumberland Advisors chief global economist and portfolio manager said. “This year and next year we see growth a little bit below 5 percent, but then picking up in 2016 through 2020 to 6-plus percent,” he told CNBC

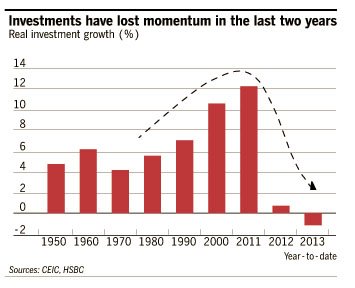

China’s latest figures reveal a sharper-than-expected slowdown at the start of 2014, curbing manufacturing, China’s largest contributor to growth and leading to an overall saturation of the market. While Beijing has already begun releasing funds into the market to stimulate the economy, the impact is minimal. Additionally, with more than $14 billion in corruption charges uncovered last week, people aren’t keen to keep their money within China, another incentive for companies to invest in India._