Diamonds are China’s new best friend and as a result fast becoming a bone of contention between the two nations.

Diamonds are China’s new best friend and as a result fast becoming a bone of contention between the two nations.

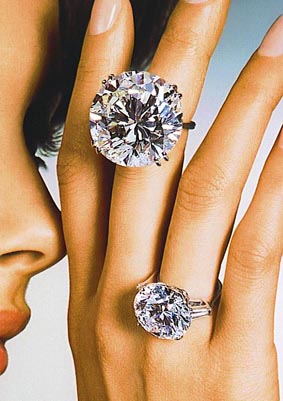

India has since years been at the forefront of the world’s diamond business. Age old ties with diamond mining companies in Africa such as De Beers and Russia’s Alrosa have allowed diamond polishing cities like Surat on India’s Western coast to flourish. India today cuts and polishes 60 percent of the world’s diamonds and sells a majority of it to the US, the world’s largest finished jewelery consumer. India exported about US$17.5 billion in cut and polished diamonds last year. That dwarfs China’s US$3 billion a year in diamond exports. However, closer ties to governments in Africa, infrastructure and financial support, equally low labor costs and a large affluent Chinese consumer base mean that a growing percentage of Africa’s diamonds are being sent to China for cutting and polishing instead. Whats more, as diamond companies see a higher profit potential in the wealthy Chinese consumer, they are more likely to sign larger deals with Chinese jewelery companies in the years to come.

This shift further East is what is bothering diamond merchants on India’s Western coast who for generations have lived a cushy life on cutting and polishing a majority of the world’s diamonds. Recently, Indian diamond cutters and polishers lobbied with the government in New Delhi to combat Chinese efforts to secure rough diamonds directly from Africa by providing the continent’s nations with medicines and resources to build infrastructure. The Council wants Delhi to follow China’s example by exchanging rough diamonds for medicines and infrastructure. It also wants India’s foreign reserves used to create a US$4 billion fund to support the sector.

The animosity over India’s dominance in the diamond market recently led to a stake out and arrest of 21 Indians for smuggling diamonds across the border from Hong Kong into Shenzen on the mainland. Importing diamonds into Hong Kong requires no import duty, whereas China reserves a 4 percent duty on the import of diamonds. Diamond traders have for years, been smuggling diamonds across the border into the mainland in an effort to evade taxes, in the second week of January this year when 21 traders got caught, the Indian diamond community which first hand witnessed Chinese legal action has become aware of the threat across the border more than ever.

Nonetheless, the arrests haven’t seemed to arrest the desire for the Indian diamond community to sell to the continuously growing affluent Chinese population. In order to promote finished jewelery in the mainland, the Gems and Jewelery Export Promotion Council (GJEPC), the apex trade body set up by the Indian ministry of commerce, has prepared plans to participate in all exhibitions in China. China hosts at least four mega gems and jewellery events every year and India has, so far, participated as a visitor. Now, GJEPC would encourage members to showcase products in exhibitions.

The Council is also looking for opportunities to organise road shows of Indian jewelery designs in all major cities ,besides continuing its annual buyer-seller meet in India, scheduled for later this year.

Its a carat and stick issues for India and the moment, the affluent Chinese consumer is incentive enough to set up offices, cut and polish in China, however, many are set in their ways, have over the years established trustworthy contacts, employees and clients in India, an important asset to have in such a business.