Indian and Chinese exporters will be severely hit as new orders cannot be booked at old exchange rates, squeezing margins, Asian banks are expected to raise interest rates and nations will erect trade barriers, bracing themselves against an onslaught of hot money from the US as the currency war deepens following the US Federal Reserve’s decision to pump in US$600 billion into the economy through debt purchases.

Indian and Chinese exporters will be severely hit as new orders cannot be booked at old exchange rates, squeezing margins, Asian banks are expected to raise interest rates and nations will erect trade barriers, bracing themselves against an onslaught of hot money from the US as the currency war deepens following the US Federal Reserve’s decision to pump in US$600 billion into the economy through debt purchases.

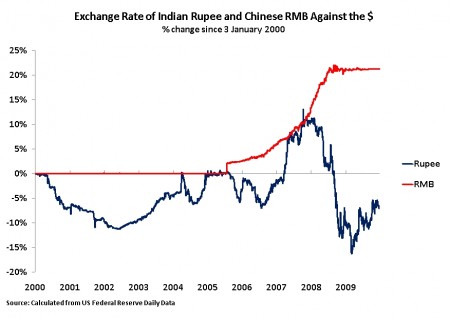

Post dismal employment and growth figures of 9.6 percent and 2 percent, respectively, the US on Wednesday effectively decided to print more money, to boost employment and growth, in a second wave of stimulus that will hopefully spur the American economy on a recovery. In retaliation, Asian nations, led by China have reacted vehemently against America’s easing monetary policy, a direct result, increased liquidity will depreciate the dollar, allowing Asian currencies to appreciate in return. Higher currencies, will make Asian exports dearer and imports cheaper. While this will adversely affect Indian exporters as all their trade is in the fully convertible dollar, Chinese exporters will not be as badly hit as a lot of the trade China conducted is regional and increasingly in the yuan which though is pegged within a band to the dollar, has been appreciating.

Gold and most Asian currencies rose against the US dollar after the Fed’s move, led by a 0.5 percent climb in the Taiwanese dollar and 0.2 percent gain in the South Korean won. New Zealand’s currency reached a 29-month high, and Australia’s dollar touched its strongest level since 1982. The MSCI Asia Pacific index of stocks advanced to the highest level since July 2008.

Post the immense pressure the US has been putting on China to appreciate the yuan over the last year, and just a week from the G20 summit, China has led the agitation against flooding the market and depreciating the dollar. Xia Bin, a member of the Chinese central bank’s monetary policy committee, branded the stimulus “abusive” and warned of a new global downturn. “If there is no restraint in issuing major global currencies such as the US dollar, the occurrence of another crisis is inevitable,” said Xia, quoted by the Beijing News. Xia urged developing countries to impose capital controls to “prevent hot money inflows from impacting their economy”. China should counter the US through regional currency alliances, speeding international use of the yuan and seeking stability in exchange rates, he added.

Asian nations that have been growing at break-neck speeds, have seen record levels of FII and FDI inflows over the past few months. Governments are now worried about hot money inflows that seek to destabilize domestic economies. Excess liquidity in domestic Asian markets will only inflate inflation, increase oil rates and raise property prices which has already reached sky-high levels, forcing central banks to further increase interest rates. While China raised interest rates for the first time since 2007 last month, and has limited the yuan to less than a 2 percent gain versus the US dollar since June, India has increased interest rates thrice this year and Rupee appreciated by 6.1 percent in the last one year and stood at 44.3 on Thursday as compared to 47.02 in November last year.