The United Kingdom’s Brexit vote to leave the European Union has hard-hitting implications on both China and India. While the true impact will be felt only in the years to come, Inchin Closer peers into the future to see what lies ahead for the diamond and ruby of the British Empire.

CURRENCY CRUNCH: The Reserve Bank of India feels that the INR is adequately buffered against the GBP. London is the second largest RMB trading hub after Hong Kong. If global banks exit London, Beijing may have to scramble for a new base. In the long run, a depreciated pound could prove beneficial to savvy investors from both countries, who will swoop in to take advantage of the devaluation.

INBOUND INVESTMENT: Thus far, both Indian and Chinese companies used the UK as a convenient conduit for unshackled access to the European markets, to circumvent the EU’s protectionist view on global trade. If the UK can no longer serve this purpose, it will certainly impact inbound investment from China and India into the UK.

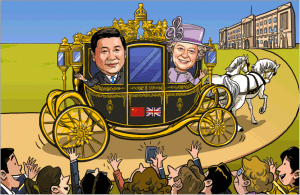

China and India have made several strategic investments in the UK, which in turn was paving the way for China to trade with the EU, one of China’s largest trade partners. China will now be forced to reevaluate its European strategy, but on the other hand, it’s negotiating muscle with the UK will strengthen. India’s trade ties with the UK may not be as greatly affected as China’s, as the economic ties between India and the UK hinge largely on the massive South Asian diaspora that lives in Great Britain.

LEARNING CURVE: Education, which is one of the biggest reasons that Indians and Chinese go to the UK, may become comparatively less expensive. Likewise, those looking to set up residence in England, may find it somewhat cheaper to do so now.

MARKET WATCH: The news of Brexit certainly had a negative impact on the stock markets of both countries, but in both cases the Chinese and Indian governments feel that the drop caused by Brexit is temporary. Less than a week post the vote, both stock markets had stabalised from an initial shock and sell moment.

COMPETITIVE LANDSCAPE: Pro-Brexit supporters see the break as an opportunity for the UK to spread wings and grow its free trade contracts with both India and China. What this means is that the Asian giants will have to compete neck to neck for their fair share of the UK’s outbound business, and it could fuel a new price war between the two countries. Whereas China may be able to make it more lucrative for the British to do business in China, the Indians have the upper hand where language and the legal system are concerned.

(NOT SO) BON VOYAGE: While business travel will be directly proportional to inbound investment, London remains one of the biggest destinations from both India and China, so leisure travelers will certainly see a price incentive.