32 years after Deng Xiaoping enacted key economic reforms in the southern city of Shenzen, metamorphosing China from communist to capitalist rule, the outgoing politibureau have left their own legacy. Coinciding with the 15th anniversary of Hong Kong’s handover to China, Beijing announced that Shenzen would be the pilot city wherein they would create a special zone to experiment with full currency convertibility.

32 years after Deng Xiaoping enacted key economic reforms in the southern city of Shenzen, metamorphosing China from communist to capitalist rule, the outgoing politibureau have left their own legacy. Coinciding with the 15th anniversary of Hong Kong’s handover to China, Beijing announced that Shenzen would be the pilot city wherein they would create a special zone to experiment with full currency convertibility.

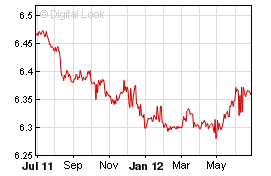

(pic: US$ Vs Chinese yuan)

Though the details are yet to be announced, it is widely expected that once the special zone is established in the Qianhai area in Shenzhen, banks in Hong Kong will be allowed to lend money to companies based in that zone. Currently, such financial transactions are not allowed by China.

Boosting free trade of the yuan, China will put in place small but key mechanisms to eventually open up China’s tightly controlled capital accounts market. It will also lay the eventual broad framework to make the yuan freely convertible by 2015, and further down the road, a global currency on par with the dollar.

“This is a logical next step of the ongoing capital account opening and yuan internationalisation,” Wei Yao, China economist at Societe Generale in Hong Kong told Reuters. China has taken several baby steps over the past few years to ensure its on track to globalise the yuan, including currency swaps with multiple nations.

In April this year, it widened the range in which the yuan can fluctuate against the US dollar to 1 percent either side of a daily price set by the central bank. The previous limit was 0.5 percent.

It has also almost tripled the amount that international fund managers can invest in China to US$80bn (£50bn).

China’s yuan was pegged to the US dollar until 2005, when it was allowed to float against a basket of currencies each day. Since then, the yuan has risen nearly 30 percent against the dollar and 27 percent against the Indian rupee just this year.

Outgoing President Hu Jinato will formally roll out the directive today, on his visit to Hong Kong. In keeping with driving the economy in dire times, China’s Central Bank also said it would continue with reforms in interest rates, currency rate and cross-border use of yuan as well as expand financing channels available to banks, allowing them to raise funds overseas and retain higher levels of profit. The banking regulator is also studying the possibility of letting banks issue preferred shares.