Recent statistics have shown a steady growth trajectory for both India and China. While GDP and manufacturing output numbers quantify a nation’s progress, softer statistics are showing a discerning upward trend.

Recent statistics have shown a steady growth trajectory for both India and China. While GDP and manufacturing output numbers quantify a nation’s progress, softer statistics are showing a discerning upward trend.

In recent report by International Finance Corporation both China and India were considered amongst the nations with the highest improvements in doing business. China was ranked 12 among the top improvers while India ranked 27. Statistics on energy consumption also show an incline depicting higher productivity and wealth. According to the Platts Top 250 Global Energy Company RankingsTM, China’s energy dragon came out roaring with 23 companies on the 2012 roster, giving the country more companies in the Top 250 than any other nation except the United States. India, too, had a strong showing on the Top 250 list, with 12 companies representing six different energy sectors. “The fact that these Asian companies are outperforming themselves year after year is a testament to the region’s enormous growth and energy demand”, Larry Neal, president of Platts said.

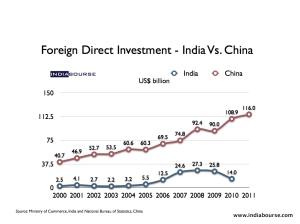

Continued high growth levels, coupled with a floundering western economy, meant that China became the world’s top destination for foreign investment in the year’s first half, edging the U.S. out of the top position for the first time since 2003. China attracted US$59.1 billion in foreign investment in the first six months, down from US$60.9 billion in the year-earlier half. in contrast, the U.N. data show that U.S. FDI inflows reached US$57.4 billion in the first half of this year, down from US$94.4 billion in last year’s period. But the U.S. may reclaim the top spot in the second half according to a report by United Nations Conference on Trade and Development. FDI flows to South Asia—in which India is the dominant country—fell 40 percent in the first half.

India’s growth has slowed sharply over the past year. While its FDI inflows have been much smaller than those into China and the U.S., India’s 43 percent drop was considerable. Indian investment flows from overseas fell to US$10.4 billion in the first half from US$18.2 billion in the first half of last year.

Clearly outlying the shift East, experts predict that China, India along with other rapidly rising Asian economies will continue to pull FDI East – where the economy is more secure, robust and will clearly dole out higher returns.

Foreign direct investment can take a number of forms, including mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations and intracompany loans. FDI makes up a significant portion of total business investment in many countries. Stagnant foreign investment flows can compound existing problems, deepening a slowdown.

“With the world slowing, foreign companies don’t have the cash flow they once had and they’re quite nervous about what their future is going to be,” said Martin Baily, an economist at the Brookings Institution, a Washington think tank.

An increasing share of investment has flowed into developing economies in recent years, chasing the faster growth rates seen in those markets compared with advanced economies. “It’s amazing the U.S. has been such a major destination for so long,” he said to the Wall Street Journal.