Card is the new cash in China and India as an increasing number of consumers buy everything from train tickets to antiques with credit and/or debit cards. While India is still testing its trust with debit and credit cards, China is ahead in adoption where an average urban consumer can boast of anywhere between 2-8 cards in her wallet.

Card is the new cash in China and India as an increasing number of consumers buy everything from train tickets to antiques with credit and/or debit cards. While India is still testing its trust with debit and credit cards, China is ahead in adoption where an average urban consumer can boast of anywhere between 2-8 cards in her wallet.

Still a status symbol in many parts of China and India, credit and debit cards are quickly gaining momentum as the preferred way to pay. While cash and cheques yet remain the most popular way to pay rising consumer spending, increasing incomes, an easier access to plastic money by banks and governments promoting cards over cash, electronic money is beginning to rule China and India.

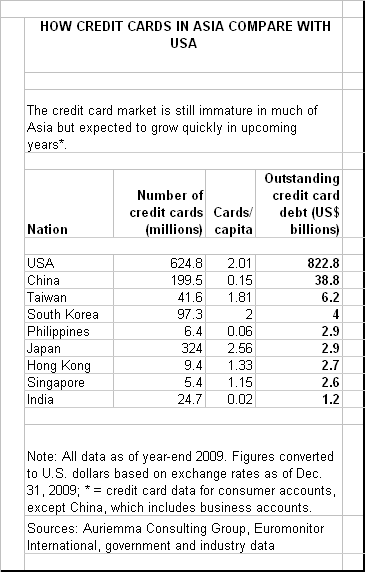

While the number of debit cards in use still dominate over credit cards, the shift in mode of payment is particularly meaningful considering the region’s historical aversion to debt, and is likely to have indelible consequences on both nations’ growth. “In most Asian economies, savings rates are very high, and consumption is very low,” says Mark Zandi, Moody’s Economy.com chief economist. Governments want to stimulate consumer spending, and “this is a way to do it.”

As electronic payments catch on they come with their virtues and vices. With a majority of urban Chinese and Indian’s increasingly swiping their cards, the black economy in which cash transactions aren’t recorded — or taxed, rife in both nations is expected to take a hit. Partly because of this, electronic payments have cumulatively added US$1.1 trillion to global GDP from 2003 to 2008, according to a study by Economy.com for Visa payment network.

Notwithstanding, there is a fear that the lure of plastic money would be too enticing for Indian and Chinese consumers who could ratchet up large debt bills. While Asia is an attractive market for electronic payments, “If people borrow too heavily, it could create a very significant economic problem,” undermining the benefit to consumers and governments, Zandi warns. Card use often begets higher spending: “It’s a proven fact that if you can make people move from cash to electronic payment, then the average (amount spent) will increase, along with the average number of transactions,” David Robertson, publisher of the Nilson Report, a payments newsletter told USA today.

Further the advent of new, cool technologies are expected to spur the rate of adoption of plastic money, enticing the Chinese and Indian consumer to buy even more. New technologies such as cellphones and contactless payments — in which you pass your card over an electronic reader rather than swipe it — promise to speed up Asian consumers’ adoption of debit, credit and even prepaid cards, which allow money to be loaded for purchases. It now needs to be seen if Chinese and Indian consumers can be more prudent about their money than their western counterparts.