~By Charmaine Mirza

‘Whoever is first in the field and awaits the coming of the enemy will be fresh for the fight; whoever is second in the field and has to hasten to battle will arrive exhausted’ – Sun Tzu, the Art of War.

WHO’S GOT GAME?

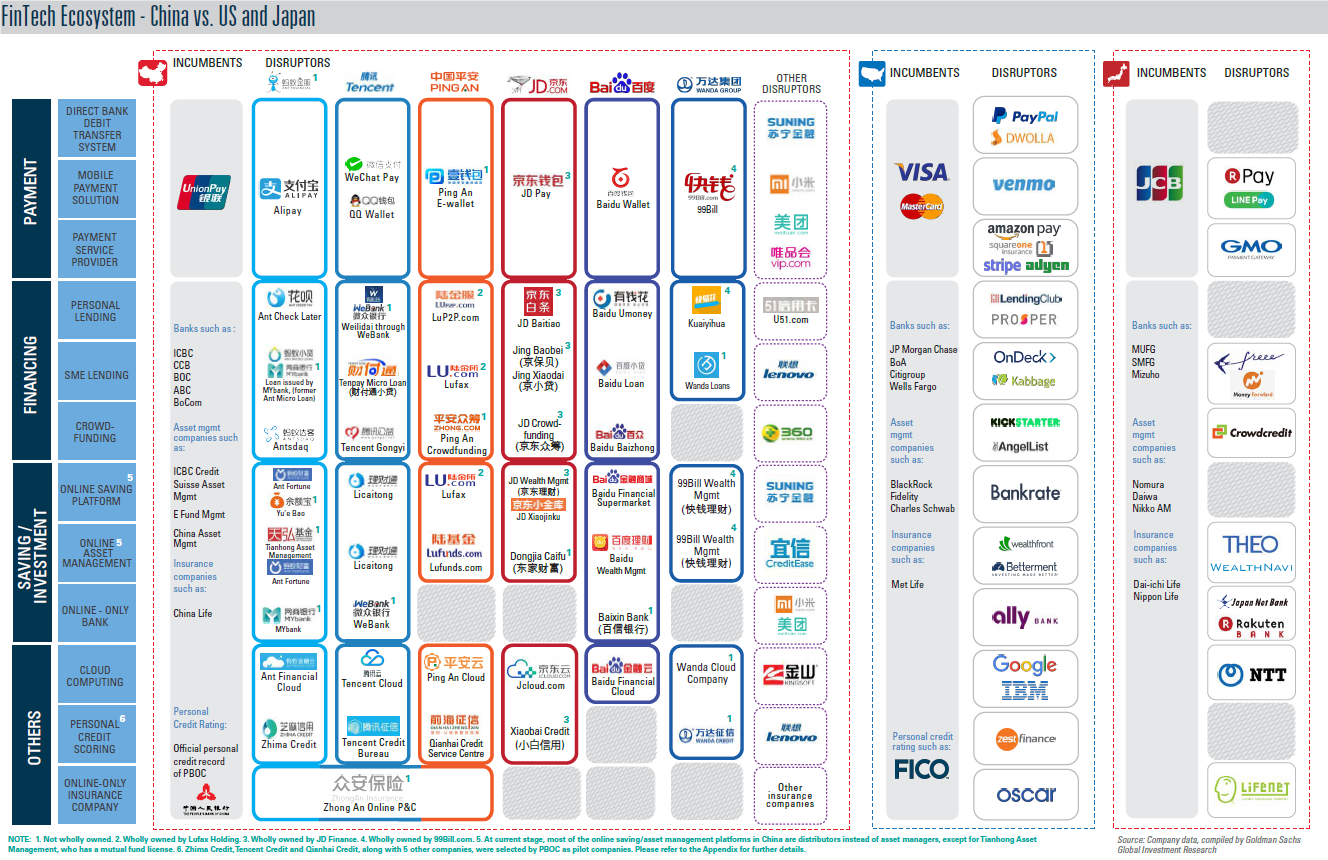

Truer words couldn’t be spoken when it comes to FinTech, China and India are choreographing an intricate two-step routine, with China taking the lead. China is spreading her roots in the Indian Subcontinent by seeding investment and sharing technology platforms with India’s burgeoning consumer economy.

BYPASSING THE BANK:

Giving people the power over their own finances, online retailers like Flipkart who are receiving funding from Chinese firms, aim to become NBFC’s (Non-banking financial corporations) in their own right, so that they can directly underwrite credit for their customers, rather than farm it out to a bank.

The China-Eurasian Economic Cooperation Fund (CEECF), a state-backed Chinese fund has also recently backed Indian cab aggregator, Ola, which is also pursuing the NBFC route.

In functionality too, having seen success in-house, Chinese companies are also betting on the “EMI” (equated month instalment) and micro loan route in India, which is rapidly gaining popularity among the youth making purchases more affordable.

Smartphone technology is driving digital payments as well as digital lending in India – and this is like offering honey to a bear. Chinese micro-lending company Fenqile and smartphone maker Xiaomi have already swarmed in and are making an investment in Bengaluru-based student lending platform KrazyBee. Xiaomi has also made another strategic investment in digital lending startup – ZestMoney, according to the Economic Times.

PEOPLE POWER:

The cross-pollination between China and India in fintech is also spreading to top tier talent. WeCash has recently hired several Indians onto its team, including Puneet Agarwal and Daman Soni from Mobikwik and Nitin Agarwal from Incred Finance – even as Tencent eyes an investment into Mobikwik. And we already know that some of the big names in Indian industry have already parked a strategic investment in Chinese companies, such as Ratan Tata’s stake in Xiaomi.

SMART CITY REVOLUTION:

However, the biggest implementation of fintech in India is yet to come with the launch of the first wave of smart-cities, and we have no doubt that Chinese technology will certainly be playing it’s part in making India’s cities “smarter.”

Even though India and China may have the occasional bout of disputes over their geographical borders, the virtual borders are already being wiped out by technology collaborations. That’s why we feel that India and China aren’t competing with one another, but are in fact leveraging their mutual interests in the FinTech space for mutual benefit.