The debate for which Asian economy – India or China is growing faster, better or stronger rages on in financial circles as investors and governments vie to fraternize with either nation. To give this argument a logical spin, Inchin Closer presents the Asian giants in numbers. Below are a few charts that will help explain where India and China came from and the direction each nation is heading towards. On a more macro level, we will also help analyse whether polices taken today will augment well for the countries going forward. This is the first in a 2 part series.  According to the IMF, as China’s economy slows and India’s picks up pace, the tiger is supposed to outrun the dragon before the end of this year, albeit marginally. According to real GDP numbers compounded, China has succeeded in growing faster and stronger than India for the past 35 years (except 3 years). However as of the end of 2014, India’s GDP is now expected to be faster than China’s.

According to the IMF, as China’s economy slows and India’s picks up pace, the tiger is supposed to outrun the dragon before the end of this year, albeit marginally. According to real GDP numbers compounded, China has succeeded in growing faster and stronger than India for the past 35 years (except 3 years). However as of the end of 2014, India’s GDP is now expected to be faster than China’s.

In the following chart, we compare sectoral growth in China and India from the time our economies opened to the world and now.  The chart shows in 1978, when economic reforms began, China was a lot more industrialised than India. Today, India continues to trump China on services while the agriculture sector in both countries has shrunk.

The chart shows in 1978, when economic reforms began, China was a lot more industrialised than India. Today, India continues to trump China on services while the agriculture sector in both countries has shrunk.  The following charts show the various components of China and India’s economic structure. It clearly shows that while consumption led to India’s growth, investments contributed significantly to China’s growth over the last few years.

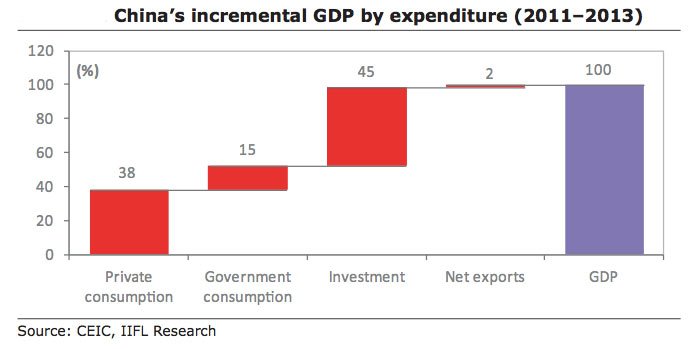

The following charts show the various components of China and India’s economic structure. It clearly shows that while consumption led to India’s growth, investments contributed significantly to China’s growth over the last few years.  China’s slowdown is bellied to the fact that the nations growth is moving from an investment led to consumption led model. Investments contributed to 45 percent of China’s incremental GDP while consumption contributed only 38 percent in the past three years (2011-13). It was the reverse for India, for whom investments contributed -5 percent of incremental GDP and consumption contributed 54 percent during 2012-14. Furthermore, urbanisation and per capital GDP also continue to fall, creating a situation similar to Japan in the 1970’s in China, as she gets older before richer.

China’s slowdown is bellied to the fact that the nations growth is moving from an investment led to consumption led model. Investments contributed to 45 percent of China’s incremental GDP while consumption contributed only 38 percent in the past three years (2011-13). It was the reverse for India, for whom investments contributed -5 percent of incremental GDP and consumption contributed 54 percent during 2012-14. Furthermore, urbanisation and per capital GDP also continue to fall, creating a situation similar to Japan in the 1970’s in China, as she gets older before richer.

As a result, Beijing’s recent decision to reduce import duties to spur domestic consumption of clothes, shoes and cosmetics is a move in the right direction. In order to re balance, both economies are now attempting to do the reverse – China to build consumption and India to grow investments. Towards this Beijing is encouraging spending power, improving the quality of domestically manufactured goods and services and reducing prices of imported goods. Meanwhile, New Delhi is attracting investments through new policies and and displaying a government thats for growth.