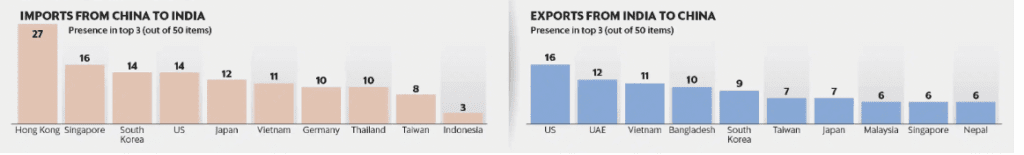

Erstwhile thick trade ties between Russia and Ukraine should be a warning signal for India whose dependence on Chinese trade has escalated, tipping the basket of goods significantly in China’s favour. While the magical number of India-China trade of US$100 billion was breached in 2021, and reached India-China trade of US$125 billion a year exactly when relations were in deep freeze over the LAC crisis is a point India didn’t highlight. India-China trade is expected to escalate in 2023 even though relations between the neighbouring nations get rough in the future.

China’s trade data for the first quarter of 2022, which came out last week, shows 2022 may be another record year. Ananth Krishnan wrote for the Hindu – A sharp increase in India’s imports of Chinese goods in the first quarter of 2022 lifted bilateral trade by 15 percent to a record US$31.96 billion, trade data released by China on Wednesday show. Imports surged 28 percent from the year-earlier period to US$27.69 billion. India’s exports, however, slumped 26 percent to US$4.87 billion.

What is worrying for India though is the implications it has on her foreign relations and therefore the geopolitics of the region. The ballooning of trade between Asia’s largest economies is predominantly due to India’s expanding imports from China. Medical supplies from China skyrocketed during the pandemic years with ppe suits, sanitizers, gloves and oxygen equipment in high demand. Additionally, India also increased imports of chemicals, API’s or the raw materials for basic pharmaceutical drugs, auto components and electronics.

India’s growing dependance on China

India imported US$16 billion more of its key top 100 imports from China in the last year, an increase of almost two-thirds from the previous year, an analysis of trade figures shows, underlining deepening dependencies on many crucial imports.

Of the 8,455 different types of items imported from China between January and November of last year, a staggeringly diverse list covering everything from a range of chemicals and electronics to auto components and textiles, 4,591 showed an increase, according to an analysis of India’s Ministry of Commerce data. The top 100 items by value accounted for $41 billion, up from $25 billion in 2020, according to a study of the numbers by Santosh Pai, an Honorary Fellow at the Institute of Chinese Studies in New Delhi.

Its complicated

India’s growing dependance on China has additional political ramifications. The more we rely on trade from across the great wall the more entwined and indebted India will be to China. This will curtail our political decisions and haunt international relations with our neighbours and allies.

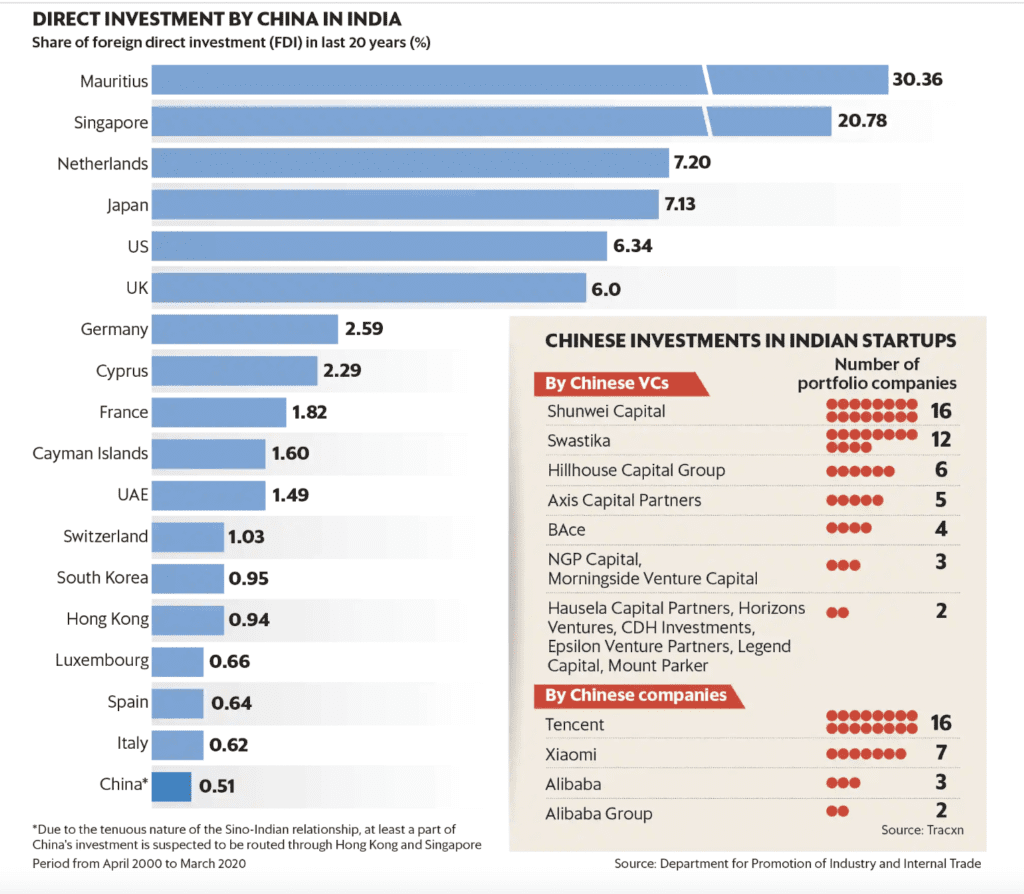

Chinese investments into Indian startups hit a 3 year high in 2021

While the valuations of Chinese technology companies are currently attractive to Indian and foreign venture capitalists, and are being studied astutely, Chinese investments into Indian startups hit a 3 year high at US$14.13 billion across 268 rounds in 2021, up from US$3.95 billion across 225 rounds in 2020, according to data sourced from Tracxn. In 2019, Chinese investors had invested US$6.68 billion in Indian start-ups across 232 deals.

Regardless of the geo-political situation, red tapism, and tough entry norms for Chinese investments into India, experts believe the surge in funding has come from 2 factors; China’s regulatory tightening of its own industries especially in the tech, fintech and education spaces as well as India’s dramatically high growth rates making her the world’s fastest growing large economy.

Where to from here?

Chinese investments into India, even if they come through various allied countries such as Singapore and Malaysia, will continue to be scrutinised. Chinese companies in India, will need to learn the Indian way of doing business, understand Indian taxes and laws better, localise and adjust more integrally into the system. Investments into the country are long term signal long term plans for the Chinese to engage with their southern neighbour. India will simultaneously need to learn how to manage growing investments from China without aborting her own homegrown industries.

In all, these 69 Chinese companies and VCs have invested in 104 Indian startups. Shunwei Capital leads with 16 portfolio companies (Cashify, Chalo, Clipapp and KrazyBee, to name a few). It is followed by Swastika, with 12 companies (including HelloDhobi, InstaCar, Makkajai, Pickrr and Pocketin).

Infact, instead of worrying about growing Chinese investments and their impact into almost every Indian industry, the Indian government should concentrate on building up indigenous industries, providing incentives and tax sops to domestic companies. The Made in India campaign needs a booster shot.