- New Delhi is mulling over expanding the export quota for cotton as production exceeds expectations. The decision is expected to take place on Friday, before crops rot.

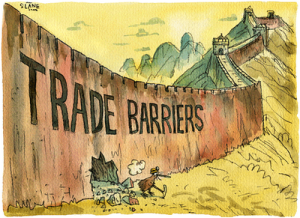

- The Indian government is considering imposing an anti-dumping duty of up to US$ 236 per tonne on imports of a chemical, used in bricks, tiles and ceramics, to protect the domestic industry from cheap Chinese shipments.

- The Directorate General of Anti-Dumping and Allied Duties (DGAD) recently extended its ban on imports of milk and milk products from China.

And now the Orissa government on India’s East coast has submitted a proposal to New Delhi to curb iron ore exports. Meanwhile, iron ore exporters and miners have challenged the ban and hearings are likely to take place this month. The key raw material for steel, Orissa’s iron ore is a vital ingredient in fueling the hungry dragons appetite to build a bigger concrete jungle.

Orissa which is India’s biggest iron ore producer, has proposed the ban on 70 percent of its exports on the grounds that its supporting domestic demand. India which favours socialism in such aspects, has created a scare in China which highly depends on its iron ore shipments. The threat of low demand, coupled with a ban from the Southern Indian state of Karnataka and flooding in Australia is expected to see prices of iron ore sky rocket. Iron ore prices more than doubled in the past two years, according to the Steel Index, on a surge in demand from India and China. Prices for the ore in China are forecast to rise another 7 percent this quarter, according to the Steel Index, published by London-based Steel Business Briefing Ltd.

Comprising a majority of the basket of traded goods between India and China, traders in the Middle Kingdom are now expected to rely on supplies from Australia and Brazil. India’s steel industry has frequently lobbied for a ban on iron ore exports so that more of it is available at lower costs. India produced more than 60 million tonnes of steel in the fiscal year to March. Growing demand from infrastructure and consumer durable sectors mean the country has to produce more. In 2009/10, India exported 117.37 million tonnes of iron ore from a total output of 226 million tonnes, but this year, exports are seen declining by a quarter or more due to the ban in Karnataka. While South Korea’s POSCO and Arcelor Mittal, the world’s biggest steel maker, have plans to build steel plants in India but their projects are mired in regulatory, environmental and land acquisition hurdles.