The storm with which Bitcoins have taken over the world is proof enough that the world demands an alternative global currency. The fact that nations are now skeptically looking at the large transactions in bitcoins however now points to its unreliability as a global currency. Chinese banks having recently banned the growing transactions of bitcoins is proof in the pudding that Bitcoins are yet not a trustworthy international currency, backed by neither institution nor nation.

The storm with which Bitcoins have taken over the world is proof enough that the world demands an alternative global currency. The fact that nations are now skeptically looking at the large transactions in bitcoins however now points to its unreliability as a global currency. Chinese banks having recently banned the growing transactions of bitcoins is proof in the pudding that Bitcoins are yet not a trustworthy international currency, backed by neither institution nor nation.

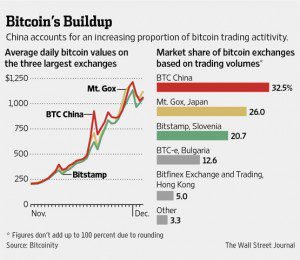

Nonetheless, bitcoin transactions in China and India have sky rocketed over the past year with rates hitting an all time high. On 28 November, the value of one bitcoin surpassed US$1,000 for the first time. Used mostly to hedge against other more real currencies, and avoid controls on trade in their own currencies, individuals are heavily investing in this four year old currency which is created through a complicated computing process called mining.

According to the Wall Street Journal, BTC China, the country’s biggest bitcoin exchange, in the last 30 days averaged 64,000 bitcoin in daily trading volume, said BTC China Chief Executive Bobby Lee. Over that period, the exchange accounted for more than one-third of volume world-wide, up from about 20 percent over the past six months, according to industry tracker Bitcoinity

Similarly, according to the Hindu, an Indian online portal for buying and selling bitcoins, buysell.co.in, has reported a leap in the number of transactions for bitcoins in Indian rupees. “We used to do about 20 transactions a day. Now, we are doing more than 50. On Monday, about 70 transactions were recorded”, said Mahin Gupta, who operates the portal out of Ahmedabad, but has a regional office in Bangalore to cater to ‘bitcoiners’ from South India.

China on Thursday banned its banks from dealing in bitcoin trade owning to its lack of a legal status and not being backed by any nation or central authority. Financial banks were to prohibit operations using bitcoins or for bitcoins to be used as legal tender currency, and entities dealing with bitcoins must track and report suspicious activity to prevent money laundering The notice came as China’s central bank the People’s Bank of China, because Chinese nationals were heavily involved in trading the virtual currency. According to the BBC, Individuals were still free to trade in bitcoins but should be aware of the risks involved, said PBOC, adding that it planned to formalise the regulation of exchanges that dealt in the digital cash. Owning to the announcement, the value of bitcoin dropped on various exchanges between 11 to 20 percent following the regulation announcement, before rebounding upward again.

Bitcoins were first mentioned in a 2008 paper published under the pseudonym Satoshi Nakamoto. They became operational in early 2009 and gained popularity during the financial downturn. As the virtual currency gained international recognition and acceptance in 2013, large companies including Virgin Galactic, OkCupid, Baidu, Reddit etc began accepting it.