~ By Charmaine Mirza

What does the Year of the Pig hold for India-China bilateral trade?

Will the pig stay at home, eat roast beef or have none?

Inchin Closer takes a look.

MAKING INROADS:

Move over Maruti Suzuki. China’s big boys in the automotive industry are about to muscle in on your turf. While Geely Motors is channelling itself through luxury brands like Daimler Benz and Volvo, SAIC Motorcorp is setting up it’s own plant in Halol to manufacture cars under the MG label.

With Electric Vehicles driving us into the future, China’s prowess in Lithium and battery technology gives it a major advantage. Other Chinese companies are worming their way in with ancillaries like motor parts and safety equipment. China is also rolling out in the tyre space. According to the Economic Times: “Of the 115 BIS licenses given for selling tyres in India, 36 are to Chinese companies.”

MINI MONEY:

Micro finance is a new watchword in India as companies extend small lines of credit and loans to lower income groups in tier II and tier III cities to help them overcome the cash-flow hurdle before each month’s pay cheque. Jade Value, the investment arm of Chinese finance firm, CashBus, recently invested in Olly Credit. China has long-term vision – Indian youth’s consumer spending is on the rise and an available line of credit helps to increase their spending power. LoanTap, another financial firm has raised a round of funding from Shunwei Capital, a Chinese VC, to offer loans and overdraft facilities to working professionals in India.

ONLINE MARKETPLACE:

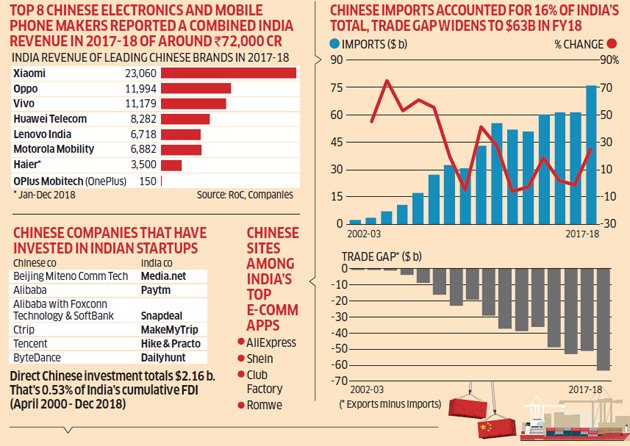

The big boys like Alibaba, Tencent and CTrip have already cast their net into the e-commerce ocean and the next wave is gearing up to wash onto India’s digital shores. India’s start-up culture is a hotbed of investment for Chinese VCs.

“Although some of the Chinese giants have already tested the water, it is expected that in the coming years, SMEs of China are also likely to explore growth opportunities in India, especially in the digital sectors, which is primarily controlled by domestic companies’ or MNCs in China,” says a report from KPMG. “Several firms including Qiming Ventures, Morningside Ventures, CDH Investments, 01VC and Orchid Asia Group are already looking to buy stakes in startups in India since the beginning of 2018.” the report added.

5G GRIDLOCK:

Chinese telecom and technology manufacturers have gone all out to be price competitive and create easy financing solutions for their Indian telecom providers — including government carrier BSNL! Their tech prowess is higher, allowing them to offer customized solutions which European and American manufacturers are unable to do. However, profitability continues to remain a big issue. Companies like Huawei and ZTE hope that introduce 5G at competitive price points will give rise to a whole host of new technology and industries that can supply incremental revenues.

CHINESE CONSTRUCT:

Made By China may soon be the tag on a lot of Indian infrastructure. Heavy equipment manufacturer, SANY, has established a factory at Chakan, just outside of Pune and aims to have sales worth 1.1 billion USD from India by 2020. Renewable energy infrastructure is another huge area of growth for the Chinese in India. 90% of solar power infrastructure and a large amount of wind power infrastructure is dominated by Chinese companies. Andhra Pradesh and Gujarat have been the immediate beneficiaries as companies like Trina, Longian, CETC, TBEA and TWBB (to name a few) have set up manufacturing centers in these states. Hunan based CRRC has won big in the railways sector, to supply metro railway coaches for several cities and has set up a joint venture manufacturing unit in Haryana.

Can’t live with them, can’t live without them. That’s the bottom line where Chinese foreign direct investment in India is concerned. It looks like this little pig is going to cry “Wei Wei Wei” all the way home.